When embarking on the exciting journey of purchasing a home or starting a new venture, understanding the nuances of financial prerequisites, such as the lending process, is crucial. One key aspect lenders review with a fine-tooth comb is your bank statement. This document is not just a summary of transactions; it paints a comprehensive picture of your financial health and habits. Let’s delve into the reasons why lenders place such importance on bank statements and how they can influence the lending decision. By demystifying this process, you’ll find yourself better equipped to navigate the pathways of securing the funding you need.

Have you ever heard terms like “sourced and seasoned funds” during the mortgage process and wondered what they mean? Essentially, these terms refer to the origin and the age of the funds in your account. Lenders are particularly interested in where your money comes from (sourced) and how long it has been in your account (seasoned), typically for up to 90 days before applying for a mortgage. This information is vital because it helps lenders assess the risk associated with lending you money. For instance, large, unexplained deposits might raise red flags, necessitating additional checks to ensure the funds are legitimate and not borrowed for the sake of inflating your bank balance.

Bank statements serve as a key proof of your financial behavior and stability, providing lenders with the confidence that you are capable of managing your money wisely. They offer a transparent view of your cash flow, indicating regular income, expenses, and how you handle your finances on a month-to-month basis. This level of detail allows lenders to verify your income and assess whether you have sufficient funds for down payments, closing costs, and future mortgage payments. In essence, your bank statement is a snapshot of your financial health, underscoring the importance of maintaining good fiscal habits, especially in the months leading up to your mortgage application.

When discrepancies in bank statements arise, a bank’s verification of deposit (VOD) can be a game-changer. This document provides lenders with an added layer of verification, showing the source of the funds in question. By offering a detailed report from your bank, a VOD can clarify any lingering doubts about the legitimacy and origin of your funds. This means that even if your bank statements raise questions, a VOD can help smooth out the wrinkles by assuring lenders that your funds are indeed legitimate and properly accounted for.

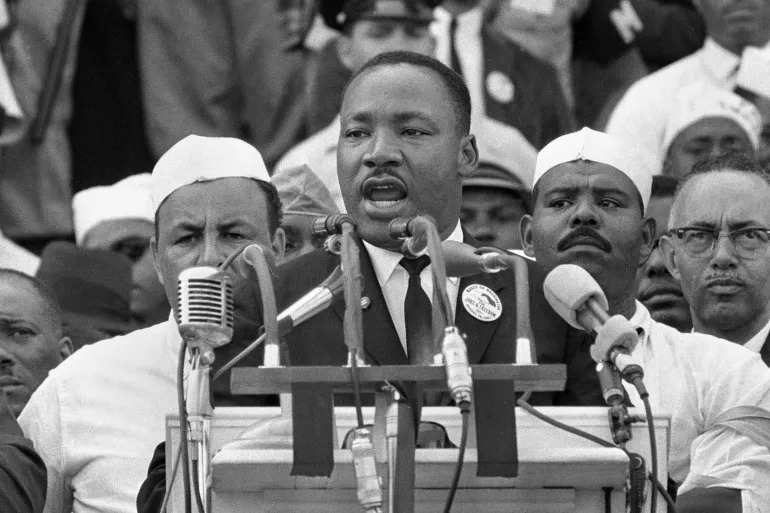

- A typical bank statement, the key document in verifying financial health for lenders. Source: rocketmoney.com

Now, how do you go about obtaining these all-important bank statements? Fortunately, accessing your bank statements is usually straightforward. Most banks and credit unions offer online banking services that allow you to download your statements directly. This method is not only efficient but it also lets you keep track of your financial statements in real time, making it easier to manage your finances and identify any potential issues well in advance of your loan application. If you’re not keen on digital downloads or prefer a tangible copy, visiting your local bank and requesting printed statements is also an option. Keep in mind that having these documents ready and in order can expedite the lending process.

When reviewing your bank statements, it’s important to understand what lenders are looking for. Make sure your statements depict a stable financial situation: regular income deposits, a reasonable balance of savings, and consistent spending habits. Unexplained large deposits or withdrawals may require further explanation, so it’s best to keep your financial movements straightforward and document any large transactions. By presenting clean, comprehensive bank statements, you’re not just fulfilling a requirement; you’re showcasing your reliability as a borrower and laying a strong foundation for a successful lending decision.

In conclusion, navigating the lending process becomes infinitely smoother when you understand the importance of bank statements. These documents are more than just a financial formality; they are a testament to your financial responsibility and stability. By ensuring your bank statements reflect sourced and seasoned funds, and by knowing how to obtain and review these documents, you’re setting the stage for a positive lending experience. Remember, in the world of lending, transparency is key, and your bank statement is a crucial piece of the puzzle. So, take charge of your financial narrative, and you’ll find that obtaining the loan you need to make your dreams a reality is well within reach.