Embarking on the journey of homeownership brings with it the crucial need for protecting your investment. Homeowners insurance isn’t just a checkbox to fulfill mortgage requirements; it’s your safety net in the face of unexpected disasters. Through an easy-to-understand breakdown, let’s explore the essentials of homeowners insurance for beginners to ensure you’re well-covered.

At its core, homeowners insurance is designed to shield you from financial loss due to damage, destruction, or theft of your property and possessions. It’s also there to cover potential liabilities—for instance, if someone were to injure themselves on your property. Understanding the scope of coverage is key to appreciating the value and peace of mind this insurance provides.

When considering homeowners insurance, it’s essential to know what is covered under standard policies. These typically include protection for your home’s structure, personal belongings, and liability for injuries that occur on your property. Each of these components plays a pivotal role in ensuring your financial stability in the aftermath of unexpected events, highlighting the importance of a comprehensive homeowners insurance policy.

Additionally, should your home become uninhabitable due to covered damage, homeowners insurance can cover the cost of temporary living arrangements. This aspect of coverage ensures that a significant house repair doesn’t have to lead to financial ruin, further illustrating the indispensable nature of homeowners insurance for safeguarding both your home and your wallet.

- An essential primer to navigating homeowners insurance for new homeowners. Source: https://www.facebook.com/Investopedia/ – investopedia.com

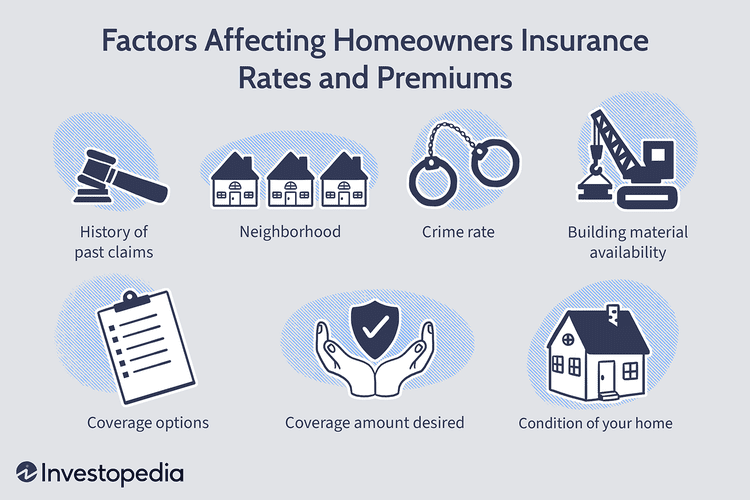

Determining the cost of homeowners insurance involves examining several factors, such as the location and condition of your property, as well as your personal claims history. These elements help insurers assess the risk of insuring your home, influencing the premium you’ll pay. Understanding these factors can empower you to take steps to potentially lower your insurance costs.

Moreover, there are several strategies to reduce your homeowners insurance expenses. Actions such as installing a security system, opting for a higher deductible, and combining multiple insurance policies under one insurer can lead to significant savings. Regularly comparing quotes from different providers also ensures you’re getting the best deal, further emphasizing the importance of proactivity in managing insurance costs.

- Understanding what your standard homeowners insurance policy covers. Source: nerdwallet.com

Shopping for the right homeowners insurance policy requires careful consideration. Start by comparing policies from various insurance companies, taking into account their financial stability, customer service reputation, and the breadth of coverage offered. Such diligence ensures that you choose an insurance provider that not only meets your needs but also provides the peace of our mind that comes from reliable protection.

Additionally, it’s advisable to obtain multiple quotes and look beyond the price tag alone when deciding on a policy. Factors like deductibles, coverage limits, and exclusions can vastly impact the effectiveness and value of your homeowners insurance, making it crucial to evaluate these aspects carefully before making your final choice.

- Key factors that influence your homeowners insurance premiums – know how to manage them. Source: https://www.facebook.com/Investopedia/ – investopedia.com

In summary, navigating your first homeowners insurance policy doesn’t have to be daunting. By understanding the basics, knowing what coverage you need, and actively seeking ways to reduce costs, you can secure the right protection for your home. Remember, homeowners insurance is more than just a requirement; it’s a strategic tool for financial stability and peace of mind in the face of the unforeseeable. With the right approach, you can ensure that your home and your finances are well-protected against whatever life may throw your way.